Institute Cargo Clauses are the foundation of a Marine Cargo Insurance Policy. It is extremely important to understand the Institute Cargo Clauses in detail so that we understand the coverages and exclusions.

There are 3 sets of Institute Cargo Clauses providing different levels of protection:

- Institute Cargo Clauses – A (ICC-A 2009 Clauses)

- Institute Cargo Clauses – B (ICC-B 2009 Clauses)

- Institute Cargo Clauses – C (ICC-C 2009 Clauses)

This article will explain the coverages and exclusion of Institute Cargo Clauses of a Marine Cargo Insurance Policy in detail.

What do the Institute Cargo Clauses in a Marine Insurance Policy convey?

The Institute Cargo Clauses in a Marine Insurance Policy broadly convey the following:

- What are the Perils against which the Subject-Matter is Insured?

- What are the Excluded Perils?

- When does the Marine Insurance Policy Start?

- How long does the Marine Cover continue?

- When does the Marine Policy end?

- Other standard conditions

What are the coverages under Institute Cargo Clauses?

Coverage under Institute Cargo Clauses – A (2009)

ICC-A Clauses (2009) are the widest cover available and they are issued on an All Risk Basis. A Marine Policy with ICC-A 2009 Clauses is issued on an unnamed perils and named exclusion basis meaning that these clauses do not say what perils are covered but only mention the exclusions. This means everything apart from what is excluded is covered under ICC-A Clauses.

The Coverage Clause under Institute Cargo Clauses – A (2009) reads as follows:

“This insurance covers all risks of loss of or damage to the subject-matter insured except as excluded by the provisions of Clauses 4, 5, 6 and 7 below”

Clauses 4, 5, 6 and 7 list types of losses or damages that are excluded by the ICC – A (2009) Clauses.

Coverage under Institute Cargo Clauses – B (2009)

ICC-B Clauses (2009) provide a more restricted cover than ICC-A Clauses (2009) but they still provide a wider cover than ICC-C Clauses (2009). ICC-B Clauses provide cover on a named peril basis.

The perils covered under ICC-B Clauses (2009) are as follows:

- Loss of or damage to the subject-matter insured reasonably attributable to

- Fire or Explosion

- Vessel or Craft being stranded grounded sunk or capsized

- Overturning or derailment of land conveyance

- Collision or contact of vessel craft or conveyance with any external object other than water

- Discharge of cargo at a port of distress

- Earthquake, Volcanic Eruption or Lightning

- Loss of or damage to the subject-matter insured caused by

- General Average Sacrifice

- Jettison or Washing Overboard

- entry of sea lake or river water into vessel craft hold conveyance container lift van or place of storage,

- Total loss of any package lost overboard or dropped whilst loading on to, or unloading from, vessel or craft

Compared to Coverage under ICC-C Clauses (2009), ICC-B Clauses (2009) offer the following additional coverages:

- Earthquake, Volcanic Eruption or Lightning

- Entry of sea lake or river water into vessel craft hold conveyance container lift van or place of storage

- Total loss of any package lost overboard or dropped whilst loading on to, or unloading from, vessel or craft

Coverage under Institute Cargo Clauses – C (2009)

ICC-C Clauses (2009) are the most restricted form of cover.

The perils covered under ICC-B Clauses (2009) are as follows:

- Loss of or damage to the subject-matter insured reasonably attributable to

- Fire or Explosion

- Vessel or Craft being stranded grounded sunk or capsized

- Overturning or derailment of land conveyance

- Collision or contact of vessel craft or conveyance with any external object other than water

- Discharge of cargo at a port of distress

- Loss of or damage to the subject-matter insured caused by

- General Average Sacrifice

- Jettison

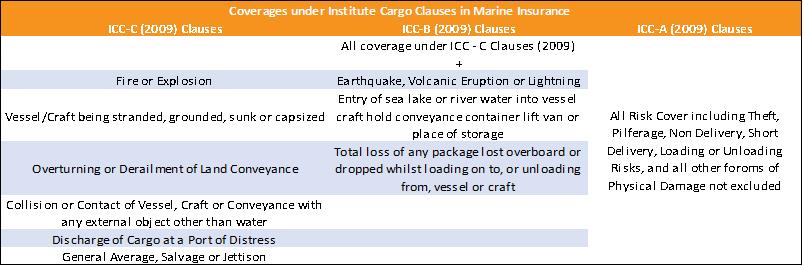

The image below summarizes the coverages under Institute Cargo Clauses

What are the exclusions under Institute Cargo Clauses?

The exclusions under Institute Cargo Clauses of a Marine Policy are classified into 4 categories:

- General Exclusions

- Vessel Seaworthiness Exclusions

- War Exclusions

- Strikes Exclusions

What are the General Exclusions under Institute Cargo Clauses in a Marine Policy?

The General Exclusions under Institute Cargo Clauses of a Marine Policy are as follows:

Loss Damage or Expense attributable to

- Wilful misconduct of the Assured

- Ordinary leakage, ordinary loss in weight or volume, or ordinary wear and tear of the subject-matter insured;

- Caused by insufficiency or unsuitability of packing or preparation of the subject-matter insured to withstand the ordinary incidents of the insured transit where such packing or preparation is carried out by the Assured or their employees or prior to the attachment of this insurance (for the purpose of these Clauses “packing” shall be deemed to include stowage in a container and “employees” shall not include independent contractors)

- Caused by inherent vice or nature of the subject-matter insured

- Caused by delay, even though the delay be caused by a risk insured against

- Caused by insolvency or financial default of the owners managers charterers or operators of the vessel where, at the time of loading of the subject-matter insured on board the vessel, the Assured are aware, or in the ordinary course of business should be aware, that such insolvency or financial default could prevent the normal prosecution of the voyage. This exclusion shall not apply where the contract of insurance has been assigned to the party claiming hereunder who has bought or agreed to buy the subject-matter insured in good faith under a binding contract;

- Caused by or arising from the use of any weapon or device employing atomic or nuclear fission and/or fusion or other like reaction or radioactive force or matter.

What are the Vessel Unseaworthiness or Unfitness Exclusions under Institute Cargo Clauses in a Marine Insurance Policy?

The second set of exclusions under the Marine Insurance Policy relates to the Unseaworthiness or Unfitness of Vessels.

The exclusion reads as follows:

“In no case shall this insurance cover loss damage or expense arising from

- Unseaworthiness of vessel or craft or unfitness of vessel or craft for the safe carriage of the subject-matter insured, where the Assured are privy to such unseaworthiness or unfitness, at the time the subject-matter insured is loaded therein;

- Unfitness of container or conveyance for the safe carriage of the subject-matter insured, where loading therein or thereon is carried out prior to attachment of this insurance or by the Assured or their employees and they are privy to such unfitness at the time of loading.

-

- Exclusion 1 above shall not apply where the contract of insurance has been assigned to the party claiming hereunder who has bought or agreed to buy the subject-matter insured in good faith under a binding contract.

- The Insurers waive any breach of the implied warranties of seaworthiness of the ship and fitness of the ship to carry the subject-matter insured to destination”

Basically, this exclusion implies that the claim under a Marine Cargo Insurance Policy is not payable of the Assured was aware at the time of loading that the Vessel or the Craft used for Carriage of Cargo was Unseaworthy or Unfit or if the Assured or his employees are unaware of the unfitness of the container or conveyance used.

What are the War Exclusions under Institute Cargo Clauses in a Marine Insurance Policy?

The War Exclusions under Institute Cargo Clauses – A (2009) (ICC-A Clauses (2009) reads as follows:

“In no case shall this insurance cover loss damage or expense caused by

- war civil war revolution rebellion insurrection, or civil strife arising therefrom, or any hostile act by or against a belligerent power;

- capture seizure arrest restraint or detainment (piracy excepted), and the consequences thereof or any attempt thereat;

- derelict mines torpedoes bombs or other derelict weapons of war”

while the War Exclusions under Institute Cargo Clauses – B (2009) and Institute Cargo Clauses – C (2009) reads as follows:

“In no case shall this insurance cover loss damage or expense caused by

- war civil war revolution rebellion insurrection, or civil strife arising therefrom, or any hostile act by or against a belligerent power;

- capture seizure arrest restraint or detainment, and the consequences thereof or any attempt thereat;

- derelict mines torpedoes bombs or other derelict weapons of war”

War is an absolute Exclusion under all the Institute Cargo Exclusions ie ICC-A, ICC-B and ICC-C Clauses do not cover War.

There is a very subtle difference in War Exclusion between ICC-A and ICC-B & ICC-C Clauses.

Even though cover for War is excluded under all 3 forms of Institute Cargo Clauses, ie ICC-A Clauses, ICC-B Clauses and ICC-C Clauses, ICC-A Clause provides cover for Piracy (though coverage for War is excluded under ICC-A Clause) while ICC-B and ICC-C Clauses do not provide cover for Privacy.

The Exclusion for War Coverage can be deleted by attaching the Institute War Clauses (Cargo) to all 3 Institute Cargo Clauses. This means that if you attach Institute War Clauses (Cargo) to Institute Cargo Clauses, War Risk gets covered under the Marine Policy. Also note that if you attach Institute War Clauses (Cargo) to ICC-B & ICC-C Clauses, also gets covered.

What are the Strike Exclusions under Institute Cargo Clauses in a Marine Insurance Policy?

The last set of exclusions under Institute Cargo Clauses in a Marine Insurance Policy are the Strikes Exclusions.

The Strikes Group of Exclusions under Institute Cargo Clauses reads as follows:

“In no case shall this insurance cover loss damage or expense

- caused by strikers, locked-out workmen, or persons taking part in labour disturbances, riots or civil commotions

- resulting from strikes, lock-outs, labour disturbances, riots or civil commotions

- caused by any act of terrorism being an act of any person acting on behalf of, or in connection with, any organisation which carries out activities directed towards the overthrowing or influencing, by force or violence, of any government whether or not legally constituted

- caused by any person acting from a political, ideological or religious motive.”

An important point to note here is that Terrorism Risk is an exclusion under the Strikes Group of Exclusions of Institute Cargo Clauses of a Marine Insurance Policy. That means Terrorism is not covered by default under a Marine Cargo Policy.

The exclusion for Strikes Coverage can be deleted by attaching the Institute Strikes Clauses (Cargo) to all 3 Institute Cargo Clauses (ICC-A, ICC-B and ICC-C Clauses). This means that if you attach Institute Strikes Clauses (Cargo) to Institute Cargo Clauses, Strikes Risk gets covered under the Marine Policy. Additionally, when you attach the Institute Strikes Clauses (Cargo) to the Marine Policy, Terrorism Risk also gets covered under the Marine Policy.

What is a Specific Exclusion under ICC-B and ICC-C Clauses of a Marine Insurance Policy?

ICC-B and ICC-C clauses have a specific exclusion for Malicious Damage which is not there in ICC-A Clause and which reads as follows:

“deliberate damage to or deliberate destruction of the subject-matter insured or any part thereof by the wrongful act of any person or persons”

The damage committed here is deliberate and does not fall under the definition of War, Strikes, Lock-outs, Riots, Civil Commotion or a Terrorist Act. It is a deliberate act by a person out of personal dislike or malice towards cargo owner.

What is the Duration Clause under Institute Cargo Clause of a Marine Insurance Policy?

The Duration Clause under Institute Cargo Clauses explains the following 3 points:

- When does the cover under the Marine Insurance Policy start?

- How long does the cover under the Marine Insurance Policy continue?

- When does the cover under the Marine Insurance Policy end?

When does the Cover under the Marine Insurance Policy start?

As per the Institute Cargo Clauses, a Marine Insurance Policy starts:

“from the time the subject-matter insured is first moved in the warehouse or at the place of storage (at the place named in the contract of insurance) for the purpose of the immediate loading into or onto the carrying vehicle or other conveyance for the commencement of transit”

This means that a Marine Policy starts even before the Cargo is loaded onto the vessel/conveyance/vehicle. Consider an example where the Cargo is there on a Wharf and the vessel is standing there, you have to move it by a truck to the vessel and then load it.

As you first pick up the cargo with a Crane, for the purpose of loading onto the truck, the crane’s chain breaks and the machinery cargo falls down and gets damaged. The claim is under the Marine Policy as per the terms and conditions.

The cargo need not be loaded onto the vehicle or conveyance, or it need not even be in the process of loading for the claim to be payable. When the cargo is first moved in the warehouse or place of storage, for the purpose of loading, the Marine Insurance Cover starts.

How long does the Cover under the Marine Insurance Policy continue?

As per the Institute Cargo Clauses, the cover under a Marine Insurance Policy continues until:

Under Institute Cargo Clauses (ICC-A, ICC-B and ICC-C Clauses), the Cover under the Marine Insurance continues as long as the subject-matter insured is in the ordinary course of transit. There is no time limitation.

Ordinary Course of Transit means when the subject matter insured is out of the control of the Insured. The transit is in the hands of a third party which could be carrier, port authorities, CFS etc. There is no question of number of days.

However, this clause must be read in conjunction with the Delay Exclusion. Marine Insurance Cover will continue as long as the Goods are in the Ordinary Course of Transit but if there is a delay, and there is a loss to the cargo because of delay, that claim (damage due to delay) will not be payable.

When does the cover under the Marine Insurance Policy end?

As per the Institute Cargo Clauses, Marine Insurance Cover terminates on the happening of the FIRST of the FOLLOWING 4 CIRCUMSTANCES

- On completion of unloading from the carrying vehicle or other conveyance in or at the final warehouse or place of storage at the named final destination OR

- on completion of unloading from the carrying vehicle or other conveyance in or at any other warehouse or place of storage, whether prior to or at the destination named in the contract of insurance, which the Assured or their employees elect to use either for storage other than in the ordinary course of transit or for allocation or distribution OR

Consider example, the goods are being sent from Dubai to Pune. The goods reach the Mumbai Port and from Mumbai the goods are supposed to be forwarded to Pune in a Truck. However, on reaching Mumbai, the Assured decides that he does not want to pay the duty and the Assured stores the goods in a Bond Warehouse. The moment the goods are put in the Custom Bond Warehouse, the Policy ceases.

Even though the Marine Policy mentions the journey from Dubai to Pune, with Pune being the final destination, the moment the goods are put into the Bonded Warehouse, in terms of Duration Clause, the ordinary course of transit is broken since the Assured has intervened and hence the cover under the Marine Policy ceases.

3. When the Assured or their employees elect to use any carrying vehicle or other conveyance or any container for storage other than in the ordinary course of transit

Another situation is where the Assured or his employees have placed the cargo in a storage space, along with the conveyance itself, the cover ceases since the cargo has been diverted to another storage place (even though the cargo is still in the conveyance itself, the transit has been assumed to be completed).

4. On the expiry of 60 days after completion of discharge overside of the subject-matter insured from the oversea vessel at the final port of discharge, whichever shall first occur.

This means that the cargo should reach its final destination within 60 Days of Discharge of Cargo at the final port. There is a lot of confusion regarding this point. This point does not mean that you can store the cargo midway as long as the cargo is reaching the destination within 60 days. If there is an interruption in the ordinary course of transit, the cover ends at that point.

The Cover under the Marine Policy ends when whichever of the above 4 points happens first.

Conclusion

Marine Cargo Insurance is complicated and needs the assistance of an experienced insurance broker. Qian is an experienced Marine Insurance Broker and can assist you with comprehensive cover at competitive premiums. If you wish to purchase a Marine Insurance Policy, you can email us at insurance@qian.co.in.

We would be glad to assist you.