A Workmen’s Compensation Insurance Policy compensates employers for their legal liability to pay compensation to the employee or their family members in case of accidental death or disablement (Permanent Total Disablement/ Permanent Partial Disablement/ Temporary Total Disablement) in the course of their employment as mandared by Workmen’s Compensation Act 1923.

The Workmen’s Compensation Act 1923 makes the employer liable to provide the employee or their family members compensation in case they suffer from accidental death or disablement during the course of their employment.

A Workmen’s Compensation Insurance Policy provides coverage for Accidental Death

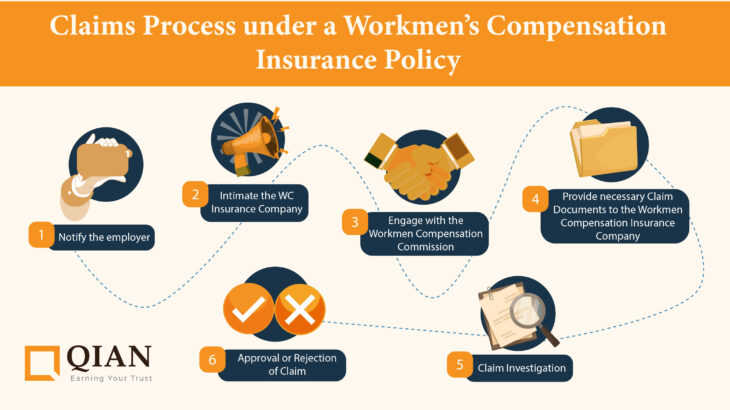

It is important for employers to understand to understand the claims process in a Workmen’s Compensation Insurance Policy.

What is the claims process in a Workmen’s Compensation Insurance Policy?

The employers need to follow the below mentioned steps while filing workmen compensation claims.

Step 1: Notify the Employer

The first step in filing for a claim under Workmen’s Compensation Insurance Policy is to notify the employer about the injury.

Employees can follow these guidelines when notifying the employer:

- Identify responsible individuals within the organization who oversee safety, such as safety officers or factory inspectors.

- Immediately report the accident to the relevant workplace authorities, providing accurate incident details. Additionally, it may also be necessary to file a First Information Report (FIR) at the nearest police station depending on the type of injury.

- Maintain detailed records of the accident, including photographs, which can be valuable for safety improvements and the claims process.

- Cooperate fully with workplace inspectors, supervisors, or relevant personnel investigating the incident.

- Implement safety measures to prevent future accidents, prioritizing workplace safety.

Step 2: Intimate the Workmen’s Compensation Insurance Company

In the unfortunate event of a workplace accident, the employer must immediately notify the insurance company about the WC Claim. The incident must be an admissible claim under the WC Policy.

As an employer, assign responsible personnel to manage accident notifications. Establish clear communication channels for employees to report accidents promptly. Keep the insurer’s contact information readily available at the workplace, including phone numbers and email addresses.

Ensure that you follow these steps when reporting an accident:

- Contact the Workmen’s Compensation Insurer’s claims department immediately.

- Provide comprehensive details about the incident, including the date, time, location, and a brief description.

- Furnish the injured employee’s personal information, such as their name, employee ID, and contact details.

Step 3: Engage with the Workmen Compensation Commission

The Workmen Compensation Commission plays a central role in resolving Workmen Compensation Claims (WC Claims). In case of death or disability of more than 50%, the employer needs to inform the Workmen’s Compensation Commissioner (WC Commissioner) about the injury/death.

The employer needs to follow these steps with the Workmen’s Compensation Commission:

- Contact the Workmen Compensation Commission, to provide accident details and the injured employee’s information.

- Participate in consultations or meetings with the Commission to present relevant documentation and evidence.

- The WC Commissioner will calculate and inform the compensation amount that has to be deposited by the employer based on injury severity and earning capacity of the employee. The Employer needs to deposit the Compensation Amount with the WC Commissioner.

- Upon depositing the compensation amount, the Commission will provide a receipt acknowledging the payment. These claim receipts need to be submitted to the Workmen’s Compensation Insurance Company while registering the claim.

In case the disability is less than 50% or it is just a temporary disability, the employer need not intimate the WC Commissioner about the accident. The Insurance Company will directly pay the compensation amount plus the medical expenses to the Insured Party.

Step 4: Provide necessary Claim Documents to the Workmen Compensation Insurance Company

The next step is to submit the workmen compensation claim documents for claims processing. Proper documentation is essential to support the claim and ensure the injured employee receives appropriate compensation.

What are the documents required to process Workmen’s Compensation Insurance Policy Claims?

The Insured needs to submit following documents for processing Workmen Compensation Claims (WC Claims):

- Duly Filled and Signed Claim Form

- ID Proof

- Employer’s ID Proof (Issued by the Employer)

- Proof/Evidence of number of employees as on date of accident

- Wage and Attendance Sheet of last 3 months (including the accident month)

- Original Hospital Bills and Documents

- Accident Report of the Company and/or detailed description

- Payment Proof indicating Medical Expense paid to the Injured

In Case of Death, following additional documents also need to be provided:

- Workmen Compensation Act’s Form A

- Post-Mortem Report and Death Certificate

- Copy of the FIR

- Proof of Compensation Amount deposited with the WC Commissioner

In Case of Permanent Disability, following additional documents also need to be provided:

- Disability Certificate from Treating Doctor/Surgeon specifying the percentage of disability

- Photographs of the Injured Person showing the affected part of the body

- Proof of Compensation Amount deposited with the WC Commissioner

In Case of Temporary Disability, following additional documents also need to be provided:

- Medical/Fitness Certificate from Attending Doctor

- Leave Certificate from the Employer

- Payment Proof indicating Compensation paid to the Injured

Step 5: Claim Investigation

The Insurance Company will investigate a Workmen Compensation Claim by appointing an investigator in case of accidental death or permanent disability. Additionally, the insurance company also reviews all claim-related documents and may also verify the incident’s circumstances, conduct independent medical evaluations, and communicate with the claimant for clarifications regarding documents.

Step 6: Approval or Rejection of Claim

The approval or rejection of a Workmen Compensation Insurance Claim is a crucial phase where the Insurance Company makes a definitive decision on the claim’s validity. Here’s an overview of this pivotal step:

Approval of WC Claim:

After thorough investigation, if the claim aligns with the Workmen’s Compensation Insurance Policy terms and conditions, the Insurance Company approves it. The claimant is promptly informed of the WC Claim approval, detailing the compensation amount and benefits they will receive. The insurer then proceeds to process the compensation, aiding the injured party with medical expenses, rehabilitation, and wage replacement as outlined in the policy.

Rejection of WC Claim:

If inconsistencies or contradictory evidence arises during investigation, the insurer may reject the claim. The claimant receives a written explanation of the rejection, including the rationale behind the decision. The rejection notice typically outlines the appeals process, allowing the claimant to contest the decision with additional documentation or through a hearing.

Understanding the implications of claim approval or rejection is vital. Complete, accurate documentation and cooperation enhance the chances of a successful claim, facilitating effective resolution.

Get the Best Quotes for Workmen’s Compensation Insurance Policy with Qian!

Qian is an experienced Insurance Broker for Workmen’s Compensation Insurance Policy having served clients across diverse sectors over the last 8 years. We can assure you of the best quotes for Workmen’s Compensation Policy and can avail the Policy in only 15 minutes. If you wish to purchase a Workmen’s Compensation Insurance Policy, email us at insurance@qian.co.in or call us on 022-22044989. We would be glad to assist you.

- What is a Workmen’s Compensation Insurance Policy?

- A Workmen’s Compensation Insurance Policy is known as Workers Compensation Policy (WC Policy) or Employee Compensation Policy.

- What is the need for a Workmen’s Compensation Insurance Policy?

- What is the Workmen Compensation Act 1923?

- What are the Coverages under a Workmen’s Compensation Insurance Policy?

- What are the Add-On Covers under a Workmens Compensation Insurance Policy?

- What is the compensation amount payable under a Workmen’s Compensation Insurance Policy?

- What are Fatal and Non-Fatal accidents under Workmen Compensation?

- What is the Cost of a Workmen’s Compensation Policy?

- Can a Claim be filed under both the WC Act and Common Law?

- What are the Exclusions under a Workmen’s Compensation Policy?

- How to make a Claim under a Workmens Compensation Policy?

- Purchase a Workmen’s Compensation Policy with Qian!

- FAQS

- Testimonials